Which of the Following Is a Characteristic of a Corporation

Stockholders not personally liable for entitys debts. Each stockholder has the authority to commit the corporation to a binding contract through his actions.

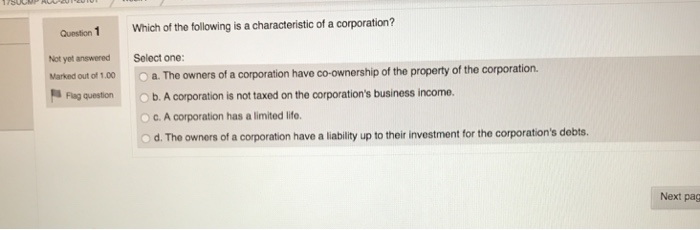

Solved Question 1 Which Of The Following Is A Characteristic Chegg Com

A corporation can own property in its name.

. Decrease the number of shares issued. C All shares of a corporation must be held by a single individual. The stockholders have limited liability is a characteristic of a corporation.

Corporations have a number of distinguishing characteristics. A Corporations are organized as a seperate legal taxable entity. A corporation is owned by stockholders B.

It is an independent legal entity on its own. Ability to Acquire Capital. Corporations and LLPs Easy transfer of ownership is a characteristic of which form Deferred income taxes.

B Ownership is divided into shares of stock. A A corporation is owned by stockholders. C Corporations experience an ease in obtaining large amounts of resources by issuing stock.

C because members of an. Which of the following is not a. What is meant by the prosperity phase is where the economy of a country is in good conditionHigh economic growth rate and low unemployment rate.

Up to 25 cash back Which of the following is not a characteristic of a corporation. Lets look at each of these in turn. Direct management by the shareholders owners c.

11 The leadership substitutes model suggests that under certain conditions managers do not have to play a leadership role A when employees may not be able to accept the companys managements philosophy. Both of the mentioned options. The corporations resources are limited to what the stockholders can contribute.

D Each stockholder has the authority to commit the corporation to a binding contract through his actions. Corporations are required to file federal income tax returns. It issues stock and adopts the same organizational structure as a C corporation which consists of shareholders a board.

Corporations are required to file federal income tax returns. Characteristics of a corporation include a. A corporation is a legal entity meaning it is a separate entity from its owners who are called stockholders.

Personal characteristics to be a successful entrepreneur includes. All shares of a corporation must be held by a single individual D. Its owners bear no personal responsibility for the debts of.

The five main characteristics of a corporation are limited liability shareholder ownership double taxation continuing lifespan and in most cases professional management. A corporation can sell shares to new investors and larger entities can issue bonds to obtain a significant amount of debt financing. Which of the following is a characteristic of a corporation.

Decrease the number of shares outstanding. A corporate is not taxed on the corporations business income. When stockholders sell their shares the corporation is dissolved.

Which of the following characteristics best describes a corporation. Cash dividends paid by a corporation are deductible as expenses by the corporation. Since it is a corporation an S Corp is formed through the submission of the Articles of Incorporation to the Secretary of State or an appropriate state agency.

The stockholders of a corporation have unlimited liability. None of the two mentioned. Lenders of a corporation do not have the right to claim the corporations assets to satisfy their obligations C.

The owner of a corporation have co-ownership of the property of the corporation. An S corporation refers to an incorporated business that is regarded as a pass-through tax entity by the IRS. All of the above.

A corporation is treated as a person with most of the rights and obligations of a real person. Double taxation is an advantage of corporations. It can be easier for a corporation to acquire debt and equity since it is not constrained by the financial resources of a few owners.

Its inability to own property. Business with a single owner. The correct answer to this question is an option B Cash dividends paid by a corporation are deductible as expenses by the corporation.

One or more owners2. A corporation has a limited life. A corporation can own property in its name.

The owners of a corporation have a liability up to their investment for the corporations. These characteristics are noted below. Characteristics of a Corporation.

Cash dividends to the stockholders are nontaxable. D A corporations resources are limited to its individual owners resources. Further explanation The business cycle is also called the economic cycle or the trade cycle.

Corporation Has Limited Liability. Professional managers are hired by the board of directors. The most significant of these are.

Therefore a corporation is fully enabled by the law to carry on its business in its own name to own property to enter into. Separate Legal Entity--- A corporation has its own separate legal personality apart from the individual legal identity of its all stockholders. B Lenders of a corporation do not have the right to claim the corporations assets to satisfy their obligations.

B when the company is facing large changes in personnel and there is no way of determining which employees will remain. The corporation can deduct cash dividends as expenses. Shareholders who are mutual agents b.

Increase the number of shares. Cash dividends paid by a corporation are deductible as expenses by the corporation. A corporation is not allowed to hold public office or vote but it does pay income taxes.

Corporations Have Their Own Lifespan. In a simple business the cycle can be interpreted as a series of economic conditions that occur repeatedly constant and. Temporary or permanent difference Various Business Finance Questions Difference between the two codes listed below Cost Management for JIT Environments Ch 11 multiple choice Choosing a jury for a fraud trial.

The following are the main characteristics of a company or corporation. The stockholders have limited liability. Which of the following is a characteristic of a corporation.

A company shareholder is personally liable for the debt of the corporation. What is the effect of the purchase of treasury stock. A corporation cannot own property in its name.

Corporation is Owned by Shareholders.

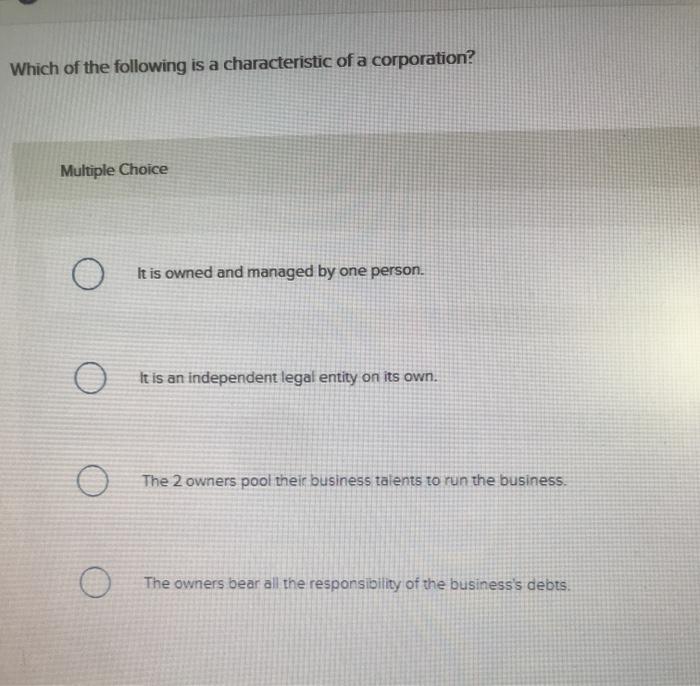

Solved Which Of The Following Is A Characteristic Of A Chegg Com

Solved Which Of The Following Is Not A Characteristic Of A Chegg Com

Solved Which Of The Following Is A Characteristic Of A Chegg Com

Comments

Post a Comment